Articles

Conrad Hilton’s Lessons For A Successful Life

Published

5 years agoon

When Conrad Hilton passed away at the grand old age of 91 in 1979, he left behind him a legacy built over six decades. When he started his own business in the year 1919, little did he know that he was going to be known as the Best Innkeeper in the World. With more than 500 hotels spread across 6 continents in the world, Conrad proved that no matter how many lemons life throws at you, you can always make lemonade. From fighting in the First World War, to coming to terms with the loss of his father and family business at the same time, Conrad Hilton has taught us how to live the successful life by following these principles:

1. Find and own your talent

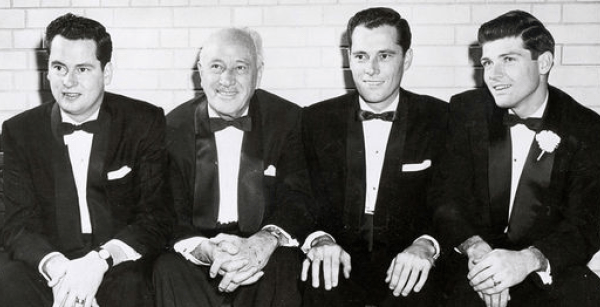

Picture credits: the1873network.org

According to Conrad Hilton, everyone is good at one particular thing. He was good at making money and making things look better than they were. While he may not have had a successful stint at becoming a banker (his life long ambition,) he definitely had a fruitful career when it came to being a hotelier. His talent lay in identifying things which weren’t working and in turning them into gold. Despite facing challenges in terms of financing the deals, he realised his talent and made sure he used it to the best of his abilities! The lesson here? Find what you are good at and no matter what, you will always succeed.

2. No empty space is a waste

Picture credits: thefamouspeople.com

When Conrad bought the Mobley Hotel (his first ever hotel,) he realised a lot could be done to change the way the downtrodden place looked. A lesson he learnt from his father, Conrad realised that in order to create something beautiful, one had to look beyond what met the eye. The first hotel Hilton owned, fit around 40 rooms and when he had a sudden spurt of inspiration, he converted the dining room and fit in another 20 beds into the space. Talk about a stroke of genius! The lesson here? Always go with your gut.

3. Don’t be obsessed with the material world

Picture credits: thefoundation.com

Conrad’s family was never a wealthy one. He saw the first signs of wealth when his father sold a gold mine to the tune of $ 110,000 (now worth $ 3 million!) However, saving was not a part of their life formula. This taught him never to be obsessed with the material aspects of life. The lesson here? The more you learn to enjoy the finer moments of life, the more you start letting go and the more you truly start to live.

4. Never cling to the past

Picture credits: thehuffingtonpost.com

One of Conrad Hilton’s major obsession was to become a barrister. However, life had other plans for him. He kept pushing forward through all the adversities. No matter where life takes you, learn from the lessons of the past. Further, if Conrad’s father had kept mulling over how the family lost their fortune, they would have never really gone beyond the fact that they had to start from scratch all over again. The lesson here? Keep looking at how to get better and life will fall into place.

5. Always have an idol

Picture credits: elpasotimes.com

One of the most important lessons Conrad learnt early on in life was to never look down on people. Only look down at people when you have to pick them up. Further, Conrad says to always learn from people, no matter what their position or what they do for a living. If Conrad hadn’t been the person he was, a bellboy wouldn’t have loaned him $ 300 when Conrad was going through a bad time! The lesson here? Everyone is an asset. Everyone has something to offer. Keep learning and growing.

6. Stop the worrying

Picture credits: huffingtonpost.com

Nothing good ever comes from worrying. According to Conrad, “Worrying has never solved anything yet. Prayer, thought, action – yes. Just worrying, no!” During the 1930s, when the Great Depression was happening, Conrad thought his business was going to sink. However, it was through sheer grit and determination that the man fought back and hit back hard! The lesson here? Everything happens for a reason. While you may blame the circumstances for your failures, don’t let them affect the rest of your life.

Conrad Hilton lived an inspiring life. Through all the ups and all the downs, the man became famous enough to build an entire industry. Today, the signature white swans on the beds, the mints on the pillows and the bellboys in crisp uniforms are all synonymous with the Hilton Worldwide Holdings Inc. Leaving behind a legacy, Conrad Hilton proved, no matter what, you can do what you truly want.

You may like

The workplace has undergone massive changes in the last century. At the turn of the Industrial Revolution, any workplace was dominated by men while the women were delegated to run the homes. However, with the advent of the internet and new and exciting technologies, workplaces have undergone a tectonic shift. Women are no longer comfortable staying at home and are instead opting to lead teams and organisations. As every year passes, we get closer to true gender equality, women have proven time and again that they are equally capable to get the job done if not better in some instances. Names like Wolfe Herd (Bumble founder,) Kylie Jenner (Kylie Cosmetics founder,) Masaba Gupta (Masaba clothing label founder) are just some of the names who are known for leading world famous brands with their unique style of leadership.

As the world celebrates International Women’s Day, we bring to you five women founders who run world famous and successful startups.

1) Upasana Taku-MobiKwik

If you are an Indian and are used to doing online shopping, more often than not at the time of payment, you would be directed to a payment gateway. One of these gateways would normally be MobiKwik. The startup is a well known name in the digital payments and digital wallet space. MobiKwik was founded by Upasana Taku in 2009, who prior to founding MobiKwik used to work with PayPal. Today Upasana Taku is also in charge of bank partnerships, business operations, and talent acquisition at MobiKwik.

2) Richa Kar-Zivame

An enthusiastic MBA student, Richa Kar, developed an online lingerie shopping platform in the year 2011. Currently, Zivame is India’s leading online lingerie store with a valuation of more than $ 100 million. The brilliant idea for her own lingerie business came to light when Richa tracked Victoria’s Secret’s sales, who was one of her clients when she was working at SAP. She observed the lingerie sales figures reached peaks overseas but, Indian women were not provided with the similar innerwear. While Richa was studying the Indian lingerie market, she realized the social embarrassment in India surrounding lingerie shopping. Today Richa Kar could be credited with destigmatising the uneasiness surrounding lingerie shopping in India.

3) Falguna Nayar-Nykaa

After a long stint as an investment banker, Falguni Nayar founded Nykaa.com in the year 2013. An online one stop shop for beauty products from Indian and international brands, Nykaa changed the world of online shopping. Who would have ever thought buying makeup online would be so easy? Falguni Nayar proved many critics wrong and created a brand new place for people who love experimenting with styles, designs and colors.

ALSO READ: Zivame: Founding Story

4) Sabina Chopra-Yatra.com

Yatra.com is a popular Indian website for making flight and hotel bookings. Sabina Chopra was instrumental in identifying the potential for travel commerce in India and people moving towards cheaper or easier travel. By the time, people started looking to make bookings, Sabina made sure Yatra.com was already in place. Sabina was the former Head of India Operations of eBookers, which is also an online travel company based in Europe. Along with this, she was also working with Japan Airlines which further adds to her experience in the travel industry.

5) Rashmi Sinha-SlideShare

SlideShare allows people to upload and access their presentations online. While this feature is presently available everywhere, SlideShare was one of the first players in making this happen. Rashmi Sinha was one of the founders of the presentation sharing platform SlideShare. The company became so successful that in 2012, LinkedIn acquired the company for an amount of $100 million.

Let us know in the comments if you know any other wonderful women who have become leaders of their right or have started up and are doing extraordinary things. We at Startup Stories wish a wonderful Women’s Day to all the women in the world who are changemakers.

Articles

Why Are Ads On Digital Media Failing To Reach The Right Audience?

Published

3 years agoon

March 1, 2021

If you are a regular user of social media platforms and also a fan of consuming content on the digital medium, then there is a very high likelihood that you have seen ads on pages you are reading or watching something. There would be times when you have been targeted by an ad which feels like it was wrongly targeted at you. Imagine if you are a vegetarian by choice and while browsing online, if you are targeted by a food delivery app which shows ads about chicken dishes. The ad would only serve to spoil the mood of the online user instead of serving its actual purpose which is to push the user to buy a chicken dish.

These wrongly targeted ads might be the side effects of performance marketing or a weak brand marketing. Performance marketing means advertising programs where advertisers pay only when a specific action occurs. These actions can include a generated lead, a sale, a click, and more. Inshort, performance marketing is used to create highly targeted ads for a very specific target audience at a low cost. Performance marketing usually means high volume for a very specific cost.

Brand marketers on the other hand believe in narrowly defining target audiences but end up spending a lot of money on ad placements. Gautam Mehra, CEO, Dentsu Programmatic India & CDO, Dentsu International Asia Pacific said, “You’ve defined a persona, you know the emotions you want to elicit, but then you buy a YouTube masthead and CricInfo sponsorships because IPL is up. If brand advertisers look at audience-based buys more deeply than just placements, you will see more relevant ads (sic.)”

ALSO READ: How Digital Marketing Is Impacted Due To The COVID-19 Pandemic

Performance marketing is more of a sales function rather than a marketing function and is about meeting the cost of acquisition. This is a reason why budgets are usually high for performance marketing. Mehra goes on to add, “the fact is that an engineer can out-beat FMCGs on performance marketing. Advertisers who have cracked this are spending 10x and are on an ‘always on’ mode (unlike time-bound brand campaigns.)”

There is always the case of supply and demand, with the supply usually exceeding the demand on digital platforms. Ultimately, it boils down to the choice between no ad versus low relevance ad and it is quite easy to guess that having a low relevance ad is better.

Arvind R. P., Director – Marketing and Communications at McDonald’s India (West and South,) said “McDonalds’ for instance, has seen its share of spends on digital grow from 20% levels a couple of years back to over 40% at present. Outcomes of this journey have been encouraging, proven by our media-mix-modelling and other key metrics. We have seen best results from an optimal mix of Television plus digital (sic.)” Moreover, Arvind also believes performance marketing only approach could turn out to be more suited to short term, versus a more consistent full funnel effort. The latter ensures adequate emphasis on building consideration, as well as growing transactions. Arvind feels digital is a complex medium which needs investment in the right talent who could use the right tools. Brands which underestimate the need for the investment are often disappointed from the return on investment from the digital medium.

With the constantly changing consumer dynamics marketers are now shifting to unscripted marketing which frankly needs more insights into the consumer mindset. The lack of marketers to do the proper research is why digital medium is plagued with irrelevant ads.

Articles

From Unicorn To Bankruptcy; Knotel Bears The Brunt Of COVID-19 Pandemic

Published

3 years agoon

February 8, 2021

It is no secret that in the fast paced world of startups, fortunes can change at the snap of fingers. Sometimes startups tend to scale so quickly that they become unicorns and sometimes the fortunes reverse so quickly that a startup can immediately go bankrupt from being a unicorn. The latter was the case for an American property technology startup Knotel, who are now bankrupt due to the disruptions by the COVID-19 pandemic.

Knotel is a property technology company quite similar to WeWork. Knotel designed, built and ran custom headquarters for companies which It manages the spaces with ‘flexible’ terms. Knotel does a mix of direct leases and revenue sharing deals. Knotel marketed its offering as ‘headquarters as a service’ or a flexible office space which could be customized for each tenant while also growing or shrinking as needed. For the revenue-share agreements, Knotel solicits clients, builds out offices, and manages properties, and shares the rent paid to it by the client with the landlord. This model is the majority revenue generator for Knotel.

In March 2020, just before the COVID-19 pandemic unleashed its economic destruction on the world, Knotel was valued at $ 1.6 billion. What is even more interesting is Knotel raised $ 400 million in Series C funding in August 2019 which led to its unicorn status. However, with the COVId-19 pandemic and its consequent lockdowns and curfews by various governments across the world, startups and businesses shifted to a remote working model. This in turn led to startups pulling out of Knotel properties to cut down on working costs.

ALSO READ: Quibi : Startup With A Billion Dollar Launch To Shutting Down All In Six Months

In late March 2020, according to Forbes, Knotel laid off 30% of its workforce and furloughed another 20%, due to the impact of the coronavirus. It was at this point that Knotel was valued at $ 1.6 billion. The company had started the year with about 500 employees. By the third week of March,Knotel had a headcount of 400. With the cuts, about 200 employees remained with the other 200 having either lost their jobs or on unpaid leave, according to Forbes.

In 2021, Knotel filed for bankruptcy and agreed to sell its assets to Newmark, one of their investors for a total of $ 70 million dollars. As work culture is still undergoing changes as a consequence of the COVID-19 pandemic and with many companies realising that remote work model saves costs and improves work efficiency, the flexible workspace sector would continue to face challenges. Knotel is just the tip of the iceberg and is a warning call for the flexible working spaces industry.

Recent Posts

- Meta’s AI Assistant, Meta AI: Friend or Foe for Searching Giants?

- Discover Kheyti, The Startup Changing The Lives of Farmers In India

- Suki: This Startup Wants To Transform Healthcare With Its Artificial Intelligence Tool

- 5 Successful Indian Startups Founded By Women

- Leher Versus Clubhouse: Which Audio Listening Startup Would You Choose?

- Why Are Ads On Digital Media Failing To Reach The Right Audience?

- Facebook Launches BARS For Creating Raps To Counter TikTok’s Growing Popularity

- How Domino’s Pizza Grew 13000% From 2008 To 2020

- Elon Musk Tweets About Bitcoin Bull Run And Loses $ 15 Billion

- Daily Basket Creates BBisabully Over Being Sued By Big Basket Over Usage Of Basket

- Bike Rental Startup Bounce Goes For A Second Round Of Layoffs Amidst Operations Scale Down

- How Parle G Became An Iconic and Well Loved Indian Brand

- Adidas To Sell Reebok Brand Due To Declining Sales

- Carl Pei’s Nothing Invites Retail Investors

- The Incredible Journey Of Wolfe Herd And The Dating App Bumble Which Went Public

- Alphabet Invests In Carl Pei’s Startup Nothing

- Bitcoin Soars As Tesla Purchases 1.5 Billion Dollars Worth Of Cryptocurrency

- From Unicorn To Bankruptcy; Knotel Bears The Brunt Of COVID-19 Pandemic

- The Journey Of Wine Recommendation App Vivino Which Raised 155 Million Dollars In Funding

- How Does Investment Startup Robinhood Make Money?

Meta’s AI Assistant, Meta AI: Friend or Foe for Searching Giants?

Discover Kheyti, The Startup Changing The Lives of Farmers In India