Articles

This Young Entrepreneur Believes In Making Stories Special

Published

6 years agoon

Everybody has a story to tell, and I help make yours unforgettable. – Ramya Sriram.

While a good measure of the millennials keeps wondering if their life choices are right, one young entrepreneur took charge of her professional journey and found her passion. Meet the 29 year old founder of The Tap, Ramya Sriram. Ms. Sriram enjoys expressing life through comics, using visual vocabulary to break language barriers. This simple and enjoyable hobby led Ramya into starting up her own business.

However, becoming an entrepreneur was not her first career choice. Like every child, Ramya, was very sure about what she wanted to do in her life. The only problem was her career choice seemed to change every few weeks! When she was 15, Ramya started coaching for medical school. Two years later, she dropped that idea altogether and joined the Vellore Institute of Technology, to pursue engineering instead.

Just like the majority of engineers feel in India, after graduating from VIT, Ramya believed a MBA was the next logical step. However, after joining a reputed Business school, Ramya realized Management was not her cup of tea. A few days into her course, she decided to quit and join a publishing house instead. At the new job, Ramya spent her days editing, nights writing and drawing, for the next five straight years.

During our conversation with Ramya Sriram, she shared about her journey from working in a publishing house, to the leap into entrepreneurship and setting up her own company.

1. While you made the move from MBA to publishing, who was your inspiration and why?

I never really wanted to do an MBA. I was quite confused when I started the course itself, though I had voluntarily studied for the entrance exam! What bothered me was that I might be stuck in a field that I might not enjoy. A week into the MBA, I knew that the course wasn’t right for me, and I needed to first find what kind of career I “fit” into. It wasn’t inspiration as much as it was resistance really. The major issue with the MBA was the time. Two entire years seemed an enormous amount of time to spend on something I wasn’t convinced about. When I got a job in a publishing house, my decision was made.

2. What would you tell other potential entrepreneurs who still are unable to make that final jump?

I can only speak from my own experience of running a very tiny outfit as a freelancer/self-employed person.

I would say that if the circumstances are favorable, then just take the plunge. Don’t let fear hold you back. I get so many mails from people who are really unhappy in their jobs. Life is too short to feel trapped. If there are people financially dependent on you, or if your circumstances are such that you can’t quit your job without some planning, then I suggest taking up small steps towards what you want to do. Even a couple of hours a week can make a big difference. I think the great thing about having a 9 to 6 job is that it gives you some leeway to freely experiment outside of it, since your bread and butter isn’t dependent on the experiments.

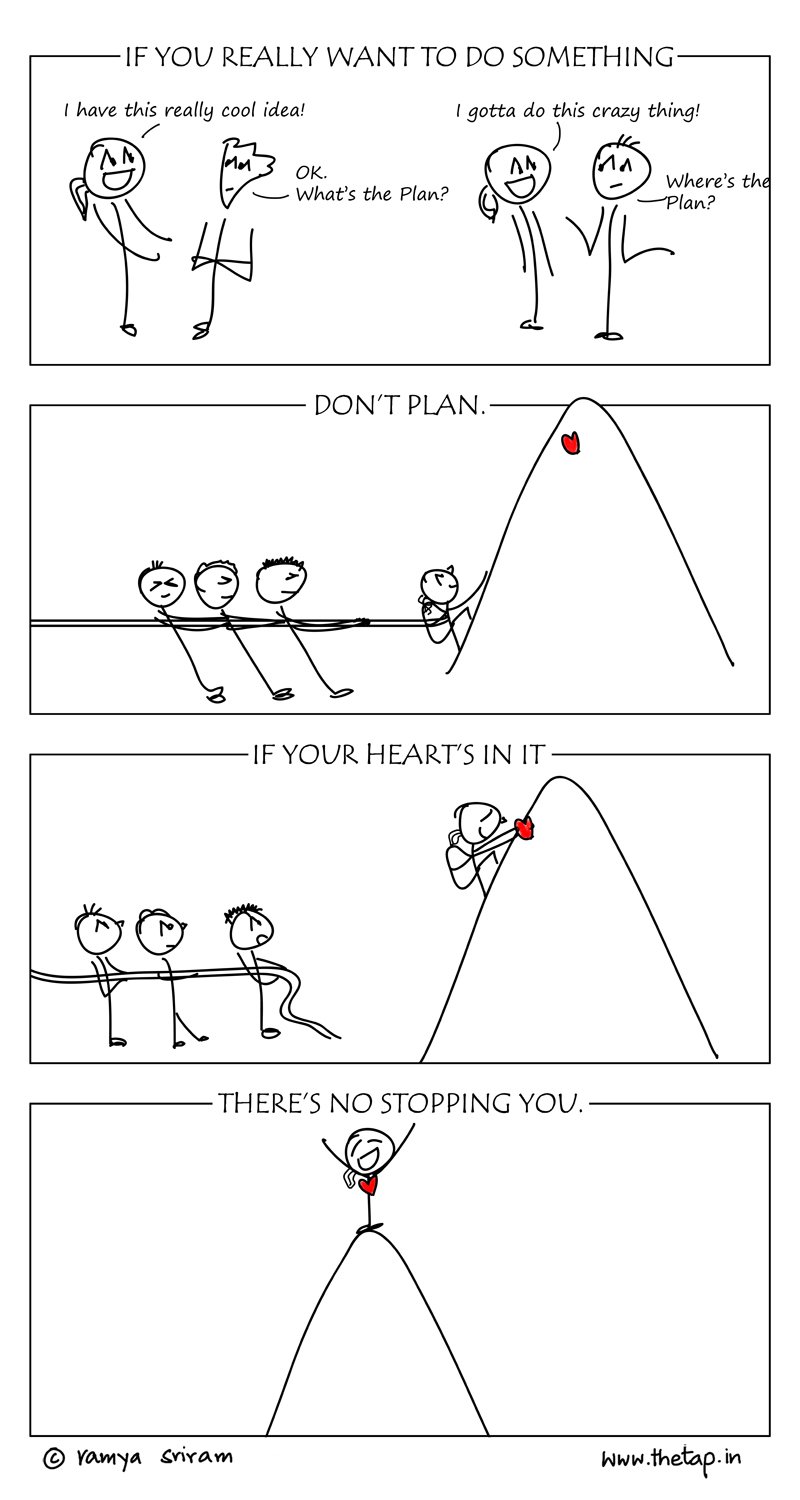

Before taking the plunge, it helps immensely to expose yourself to a variety of audiences and get feedback/advice from mentors. And when you really want to do something, you will.

Ramya’s path, from making the move from engineering, to MBA, to working in a publishing house, to finally starting her own company, Ramya has written about her journey in a Linkedin post. She states, “You can’t always find your passion within you, you have to get out there and look for it. Make things happen. Unless you try a whole variety of things, you might never know what truly brings you joy or satisfaction. As Bernard Shaw said, “Life isn’t about finding yourself. Life is about creating yourself.”

And so, The Tap was born! The Tap has now become “a storehouse for stories that originate from my wandering mind and pondering pencil.” What started off as a hobby brought in her first customer via Facebook when a friend asked her to run a comic strip for his magazine. Since then, Ramya has worked on a variety of projects that involve ideation and content creation.

3. What was the hardest part about deciding to start The Tap?

I have to admit that it wasn’t very hard, mostly because I knew what I wanted to do, and had a lot of support from my family. I had started The Tap as something on the side, along with a full-time job. By the time I decided to work solely on The Tap, I had a general idea of what kind of time, energy and effort it would involve.

I think I have to emphasize that I never really looked at The Tap as a big commercial venture or something that I wanted to grow into a big company. I wanted to focus on learning and doing good work for good clients. During the initial few months I was a little alarmed whether I could actually make it work. But there was only one way to find out.

4. What were some of the first milestones and major challenges of The Tap?

The first milestone was my first (very unexpected) commission. I was doodling for fun, and putting up my work on Facebook, when I received a request to create a custom comic. I was very surprised and happy, and that was what prompted me to start taking up paid work. Another huge milestone was Comic Con, in Bangalore. I went with some T-shirts, bags, pillow covers and coasters, and was thrilled with the response. Having your audience in flesh and blood in front of you makes such a huge difference, after an online following. The biggest thrills have come in the form of mails from readers online — lots of folks have sent me their own stick drawings — people aged 7 to 70!

The major challenge was being able to understand what the scope of The Tap was — there were so many things I wanted to do — make merchandise, take up commissions, work with social enterprises, create custom products, collaborate with other artists/writers AND continue to write. I finally decided to pick a couple of things every year.

5. What’s the next step for The Tap?

I would like to focus on social issues. I did a series with CRY India last year, and I’m hoping to work with more NGOs this year, so that people not only read the comic but there is some follow-up action. I would like to create stories that will drive people into taking positive, effective steps — though I’m not sure that can be achieved easily.

Here’s a comic I did on the International Day of the Girl Child last year.

6. What would your message be to other aspiring and confused entrepreneurs?

Well, I think the confusion is good, because it can be a great motivator. I think my advice would be to just do something which makes you wake up every day feeling excited and energetic (sic.) We are our own demons sometimes, so clearing your path of self doubt would be a good step in figuring out your next steps.

Like Ramya said, the future is all yours to grab with just a little bit of luck, a dose of courage and a whole lot of determination! We wish Ramya Sriram all the very best for her future with more projects, more milestones, more drawings and more stories!

You may like

The workplace has undergone massive changes in the last century. At the turn of the Industrial Revolution, any workplace was dominated by men while the women were delegated to run the homes. However, with the advent of the internet and new and exciting technologies, workplaces have undergone a tectonic shift. Women are no longer comfortable staying at home and are instead opting to lead teams and organisations. As every year passes, we get closer to true gender equality, women have proven time and again that they are equally capable to get the job done if not better in some instances. Names like Wolfe Herd (Bumble founder,) Kylie Jenner (Kylie Cosmetics founder,) Masaba Gupta (Masaba clothing label founder) are just some of the names who are known for leading world famous brands with their unique style of leadership.

As the world celebrates International Women’s Day, we bring to you five women founders who run world famous and successful startups.

1) Upasana Taku-MobiKwik

If you are an Indian and are used to doing online shopping, more often than not at the time of payment, you would be directed to a payment gateway. One of these gateways would normally be MobiKwik. The startup is a well known name in the digital payments and digital wallet space. MobiKwik was founded by Upasana Taku in 2009, who prior to founding MobiKwik used to work with PayPal. Today Upasana Taku is also in charge of bank partnerships, business operations, and talent acquisition at MobiKwik.

2) Richa Kar-Zivame

An enthusiastic MBA student, Richa Kar, developed an online lingerie shopping platform in the year 2011. Currently, Zivame is India’s leading online lingerie store with a valuation of more than $ 100 million. The brilliant idea for her own lingerie business came to light when Richa tracked Victoria’s Secret’s sales, who was one of her clients when she was working at SAP. She observed the lingerie sales figures reached peaks overseas but, Indian women were not provided with the similar innerwear. While Richa was studying the Indian lingerie market, she realized the social embarrassment in India surrounding lingerie shopping. Today Richa Kar could be credited with destigmatising the uneasiness surrounding lingerie shopping in India.

3) Falguna Nayar-Nykaa

After a long stint as an investment banker, Falguni Nayar founded Nykaa.com in the year 2013. An online one stop shop for beauty products from Indian and international brands, Nykaa changed the world of online shopping. Who would have ever thought buying makeup online would be so easy? Falguni Nayar proved many critics wrong and created a brand new place for people who love experimenting with styles, designs and colors.

ALSO READ: Zivame: Founding Story

4) Sabina Chopra-Yatra.com

Yatra.com is a popular Indian website for making flight and hotel bookings. Sabina Chopra was instrumental in identifying the potential for travel commerce in India and people moving towards cheaper or easier travel. By the time, people started looking to make bookings, Sabina made sure Yatra.com was already in place. Sabina was the former Head of India Operations of eBookers, which is also an online travel company based in Europe. Along with this, she was also working with Japan Airlines which further adds to her experience in the travel industry.

5) Rashmi Sinha-SlideShare

SlideShare allows people to upload and access their presentations online. While this feature is presently available everywhere, SlideShare was one of the first players in making this happen. Rashmi Sinha was one of the founders of the presentation sharing platform SlideShare. The company became so successful that in 2012, LinkedIn acquired the company for an amount of $100 million.

Let us know in the comments if you know any other wonderful women who have become leaders of their right or have started up and are doing extraordinary things. We at Startup Stories wish a wonderful Women’s Day to all the women in the world who are changemakers.

Articles

Why Are Ads On Digital Media Failing To Reach The Right Audience?

Published

3 years agoon

March 1, 2021

If you are a regular user of social media platforms and also a fan of consuming content on the digital medium, then there is a very high likelihood that you have seen ads on pages you are reading or watching something. There would be times when you have been targeted by an ad which feels like it was wrongly targeted at you. Imagine if you are a vegetarian by choice and while browsing online, if you are targeted by a food delivery app which shows ads about chicken dishes. The ad would only serve to spoil the mood of the online user instead of serving its actual purpose which is to push the user to buy a chicken dish.

These wrongly targeted ads might be the side effects of performance marketing or a weak brand marketing. Performance marketing means advertising programs where advertisers pay only when a specific action occurs. These actions can include a generated lead, a sale, a click, and more. Inshort, performance marketing is used to create highly targeted ads for a very specific target audience at a low cost. Performance marketing usually means high volume for a very specific cost.

Brand marketers on the other hand believe in narrowly defining target audiences but end up spending a lot of money on ad placements. Gautam Mehra, CEO, Dentsu Programmatic India & CDO, Dentsu International Asia Pacific said, “You’ve defined a persona, you know the emotions you want to elicit, but then you buy a YouTube masthead and CricInfo sponsorships because IPL is up. If brand advertisers look at audience-based buys more deeply than just placements, you will see more relevant ads (sic.)”

ALSO READ: How Digital Marketing Is Impacted Due To The COVID-19 Pandemic

Performance marketing is more of a sales function rather than a marketing function and is about meeting the cost of acquisition. This is a reason why budgets are usually high for performance marketing. Mehra goes on to add, “the fact is that an engineer can out-beat FMCGs on performance marketing. Advertisers who have cracked this are spending 10x and are on an ‘always on’ mode (unlike time-bound brand campaigns.)”

There is always the case of supply and demand, with the supply usually exceeding the demand on digital platforms. Ultimately, it boils down to the choice between no ad versus low relevance ad and it is quite easy to guess that having a low relevance ad is better.

Arvind R. P., Director – Marketing and Communications at McDonald’s India (West and South,) said “McDonalds’ for instance, has seen its share of spends on digital grow from 20% levels a couple of years back to over 40% at present. Outcomes of this journey have been encouraging, proven by our media-mix-modelling and other key metrics. We have seen best results from an optimal mix of Television plus digital (sic.)” Moreover, Arvind also believes performance marketing only approach could turn out to be more suited to short term, versus a more consistent full funnel effort. The latter ensures adequate emphasis on building consideration, as well as growing transactions. Arvind feels digital is a complex medium which needs investment in the right talent who could use the right tools. Brands which underestimate the need for the investment are often disappointed from the return on investment from the digital medium.

With the constantly changing consumer dynamics marketers are now shifting to unscripted marketing which frankly needs more insights into the consumer mindset. The lack of marketers to do the proper research is why digital medium is plagued with irrelevant ads.

Articles

From Unicorn To Bankruptcy; Knotel Bears The Brunt Of COVID-19 Pandemic

Published

3 years agoon

February 8, 2021

It is no secret that in the fast paced world of startups, fortunes can change at the snap of fingers. Sometimes startups tend to scale so quickly that they become unicorns and sometimes the fortunes reverse so quickly that a startup can immediately go bankrupt from being a unicorn. The latter was the case for an American property technology startup Knotel, who are now bankrupt due to the disruptions by the COVID-19 pandemic.

Knotel is a property technology company quite similar to WeWork. Knotel designed, built and ran custom headquarters for companies which It manages the spaces with ‘flexible’ terms. Knotel does a mix of direct leases and revenue sharing deals. Knotel marketed its offering as ‘headquarters as a service’ or a flexible office space which could be customized for each tenant while also growing or shrinking as needed. For the revenue-share agreements, Knotel solicits clients, builds out offices, and manages properties, and shares the rent paid to it by the client with the landlord. This model is the majority revenue generator for Knotel.

In March 2020, just before the COVID-19 pandemic unleashed its economic destruction on the world, Knotel was valued at $ 1.6 billion. What is even more interesting is Knotel raised $ 400 million in Series C funding in August 2019 which led to its unicorn status. However, with the COVId-19 pandemic and its consequent lockdowns and curfews by various governments across the world, startups and businesses shifted to a remote working model. This in turn led to startups pulling out of Knotel properties to cut down on working costs.

ALSO READ: Quibi : Startup With A Billion Dollar Launch To Shutting Down All In Six Months

In late March 2020, according to Forbes, Knotel laid off 30% of its workforce and furloughed another 20%, due to the impact of the coronavirus. It was at this point that Knotel was valued at $ 1.6 billion. The company had started the year with about 500 employees. By the third week of March,Knotel had a headcount of 400. With the cuts, about 200 employees remained with the other 200 having either lost their jobs or on unpaid leave, according to Forbes.

In 2021, Knotel filed for bankruptcy and agreed to sell its assets to Newmark, one of their investors for a total of $ 70 million dollars. As work culture is still undergoing changes as a consequence of the COVID-19 pandemic and with many companies realising that remote work model saves costs and improves work efficiency, the flexible workspace sector would continue to face challenges. Knotel is just the tip of the iceberg and is a warning call for the flexible working spaces industry.

Recent Posts

- Discover Kheyti, The Startup Changing The Lives of Farmers In India

- Suki: This Startup Wants To Transform Healthcare With Its Artificial Intelligence Tool

- 5 Successful Indian Startups Founded By Women

- Leher Versus Clubhouse: Which Audio Listening Startup Would You Choose?

- Why Are Ads On Digital Media Failing To Reach The Right Audience?

- Facebook Launches BARS For Creating Raps To Counter TikTok’s Growing Popularity

- How Domino’s Pizza Grew 13000% From 2008 To 2020

- Elon Musk Tweets About Bitcoin Bull Run And Loses $ 15 Billion

- Daily Basket Creates BBisabully Over Being Sued By Big Basket Over Usage Of Basket

- Bike Rental Startup Bounce Goes For A Second Round Of Layoffs Amidst Operations Scale Down

- How Parle G Became An Iconic and Well Loved Indian Brand

- Adidas To Sell Reebok Brand Due To Declining Sales

- Carl Pei’s Nothing Invites Retail Investors

- The Incredible Journey Of Wolfe Herd And The Dating App Bumble Which Went Public

- Alphabet Invests In Carl Pei’s Startup Nothing

- Bitcoin Soars As Tesla Purchases 1.5 Billion Dollars Worth Of Cryptocurrency

- From Unicorn To Bankruptcy; Knotel Bears The Brunt Of COVID-19 Pandemic

- The Journey Of Wine Recommendation App Vivino Which Raised 155 Million Dollars In Funding

- How Does Investment Startup Robinhood Make Money?

- The Story of Mens Grooming Startup Bombay Shaving Company